Our latest issue will be released in 7 days, don't miss out!

You have worked hard for your money and you need the right information to make sure you invest it well. And you cannot afford the time trawling the whole stockmarket or justify the money in buying a number of expensive analyst reports? And the news archives you have access to really don't help that much?

This is where Sharewatch is different. We're focused on analysing the quoted small company sector in the UK. We have access to all the best quality pay-access analyst information and unlike the national newspapers' broad sweeps, we will meet with nearly all the companies we feature. And we're not journalists - we're practitioners - so we're less interested in breaking news and more interested in producing quality analysis for our subscribers.

Convinced?

SUBSCRIBENot convinced? Read on...

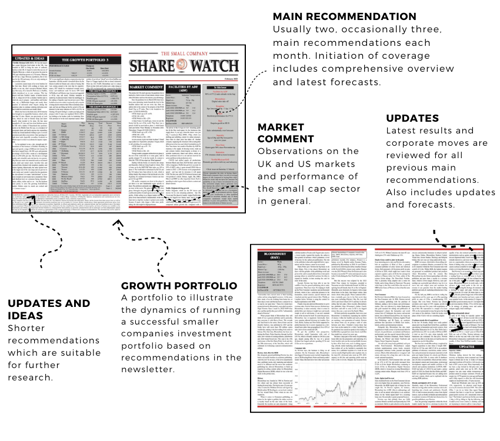

A monthly newsletter sent in hard copy format (and free access to the online version): this contains at least two new main profiles each month, smaller articles for further research, updates to previous profiles and any changes made to our Growth Portfolio. Why not try a search to see what there is?

Online access to our archive of past issues: we have put 15 years of research online, which we've indexed so you can quickly find the best information on the web. What have we got in our Archive? Take a look...

Growth Portfolio: reading research is good but seeing a portfolio in action is even better. Remember, past performance is not an indication of future performance and you may lose some or all of the money that you invest in shares. The performance of individual companies can vary widely and some can fail.

Launched in November 1994, shares in our Sharewatch Growth Portfolio 1, a virtual portfolio that only bought shares profiled in the newsletter, based on an investment of £25,000, delivered stunning growth of 1089% before receipt of dividends, before being terminated in July 2001. This represented a capital gain of £272,142. Over the same period, Sharewatch has delivered growth some 12.8x better than the FTSE-All Share.

Growth Portfolio 2 was launched in March 2001 and was terminated on 28th November 2014, with a value of £653,643, a gain of 1207.29% This compared to the FTSE-100, which rose just 17.51% over the same period and the FTSE All-Share Index, which increased 34.39%.

Growth Portfolio 3 was launched in January 2015 and is already showing a gain of 307.7% (as at the January '24 issue publish date).

Our Growth Portfolio is an excellent way to learn the dynamics of managing a portfolio.

View the latest portfolio performance to understand our performance.

Convinced?

SUBSCRIBENot convinced? Read on...

Samples. If you want to see a sample of a past issue then you can download a sample issue on our homepage or you can contact us and we can arrange for a sample to be posted to you. Also, you can search our archive for free and see excerpts from the final content. This should give you a good idea of what is there.

Our existing subscribers. Have a look at the quotes throughout this site for testimonials

Our heritage. We've been doing this an incredibly long time, since 1993 in fact, and most of our subscribers have been with us for many years (8.5 years on average to be precise!) so we must be doing something right...

Our resources. Since 1993 we have been visiting nearly every single company we write about and have therefore developed an effective network of contacts at director level. No other editor visits more than 100 companies each year. We also hold a massive collection of resources in our research library and this is growing each day...

Our people. The same team has been in place since 1993. The Editor has established an effective network of contacts including brokers, analysts and company management and has also previously been a director of a number of quoted companies and therefore has a more informed outlook on the sector when compared to other analysts or journalists.

Our performance. The only thing we newsletter publishers have to sell is the quality of the companies we feature. If we weren't delivering results, we would not have subscribers who renew year after year.

Convinced?

SUBSCRIBENot convinced? Read on...

As described in answer 1, we feel we provide better value and more useful information than competing services but we'd love to hear from you if you think otherwise (contact us). You can get some good information for free by searching the web, of course, that is if you have the time and know the good from the bad. However, the reports we publish don't exist anywhere else and the pay-access content we bring together in our archive certainly isn't available via the web for free. Nor are the companies we are adding to our portfolio brought together, of course.

Convinced?

SUBSCRIBENot convinced? Read on...

An individual annual subscription costs £199. We do a specially discounted first year subscription (use code: 30OFFSCSW) so you can give it a try at a lower cost. Ultimately, you'll be the judge of whether you think that represents good value. But as this gives you complete access to all our subscription content, we think it is a good deal. You would burn a lot of shoe leather if you visited as many companies as we do. And if you subscribed separately to the various analysts' research we also sift through each month, you'd pay several thousand pounds.

Convinced?

SUBSCRIBENot convinced? Read on...

Individual Investors, Institutional Investors, Company Directors, Stock Brokers.

Many investors tell us Sharewatch is the only investment publication they read, as if to say, "If it's not in Sharewatch, it's not worth buying".

Convinced?

SUBSCRIBE